City Council approves property tax rate increases

By CHRISTIAN MAITRE

Waltham Times Contributing Writer

The City Council last week voted to increase the tax rates for residential and commercial property owners in the city.

The new residential tax rate will be $9.82 per $1,000 of assessed valuation, while the commercial tax rate will be $21.04 per $1,000 of assessed valuation.

For comparison, the residential tax rate for fiscal 2024 was $9.64 per $1,000 of assessed valuation. The commercial tax rate for fiscal 2024 was $20.71 per $1,000 of assessed valuation.

When factoring in the residential exception, Board of Assessors Chairman Francis P. Craig said the increase will add $115 to the annual tax bill for the average single-family home.

A residential exception excludes a portion of a residential property’s value from taxation.

Craig said the exemption will be $301,987 for fiscal 2025. According to the city’s website, the fiscal 2024 residential exemption reduces the assessed value on a residence by $285,048.

The exemption applies to homes valued under about $1.45 million, Craig said, adding that “92% of parcels benefit from that residential exception.”

The attending council members all voted in favor of the increase during a special City Council meeting held Monday, Nov. 25. They also all voted to approve the residential exemption rate. Councilor Paul J. Brasco was absent from the meeting.

Valuations, tax bills increase

Prior to the vote, during which Craig shared a detailed presentation highlighting trends in the city’s property valuations for both residential and commercial properties as well as for tax rates and the tax levy.

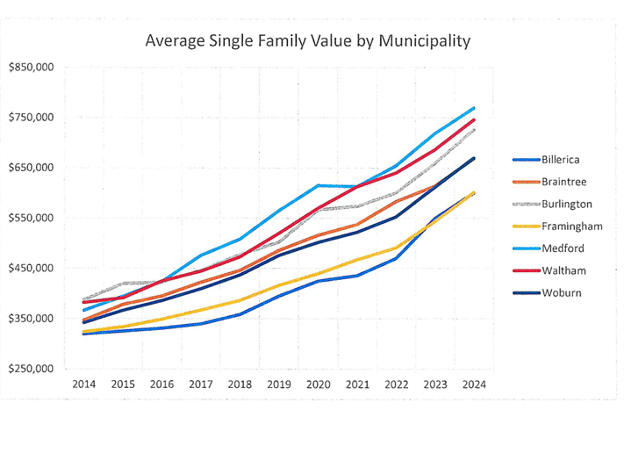

For example, Craig said the average valuation for a single-family home in Waltham increased by $20,000 from fiscal 2024 to fiscal 2025, going from $745,635 to $765,876.

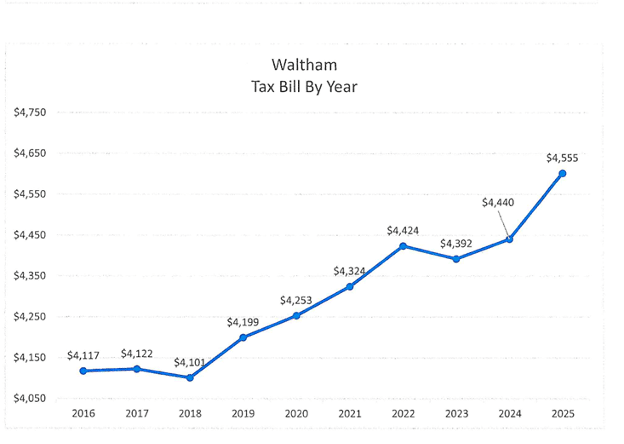

The average tax bill went from $4,440 in fiscal 2024 to $4,555 in this fiscal year, he said. That’s up from $4,117 in 2016.

Despite the increase, the property bill for the average single-family house in Waltham runs significantly below the bill for such properties in similar communities in the Greater Boston region, according to the data presented by the assessors at last Monday’s meeting. For example, the average bill in Woburn is around $5,500 while Framingham’s is around $7,500.

Waltham versus other communities

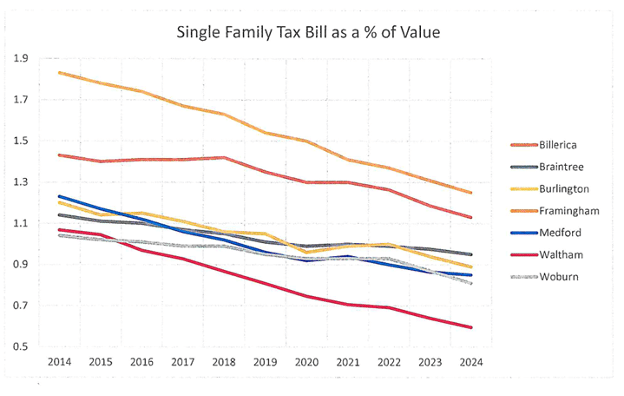

The assessors’ data also showed that the property tax bill for the average single-family home in Waltham as a percentage of its value is on the decline: In 2014, the tax bill equaled about 1% of assessed value; now it’s less than .7% – making it the lowest ratio compared to six other area communities of similar makeup (Billerica, Braintree, Burlington, Framingham, Medford and Woburn).

Craig noted, however, that the gap between the city’s assessed value for houses and sale prices for single-family homes widened over the past year. The assessed value for the average single-family home was 91% of sale price in fiscal 2024; it is 88% for fiscal 2025 – dropping outside of the state guidelines recommending assessed value run between 90% to 110% of sale price.

Craig said assessors “will be tracking up on our average single value” in the coming year.

The full City Council meeting, including Craig’s presentation, can be seen here.

Thanks for reading! If you value our reporting, please support The Waltham Times through a tax-deductible gift.

Share anonymous news tips

You can leave a news tip anonymously, but if you would like us to follow up with you, please include your contact information