Municipal tax rates to rise sharply in 2026, but home values keep pace

The City Council set the 2026 municipal tax rates at a special meeting Monday.

The council set Waltham’s residential property tax rate at $10.32 per $1,000 of property value for fiscal 2026, a 5% increase over 2025’s rate.

For the average single-family home, this will come out to $4,894.78 in property taxes, or an increase of approximately $84.84 per quarter. Even adjusted for inflation, this is the most Waltham’s property taxes have risen in a single year since 2010.

Still, the tax rate itself is exactly equivalent to the rate the city set four years ago for 2023. Board of Assessors Chair Frank Craig said one of the major factors contributing to the higher tax bill is the rise in Waltham’s property values, which have continued to grow rapidly — approximately doubling since 2015.

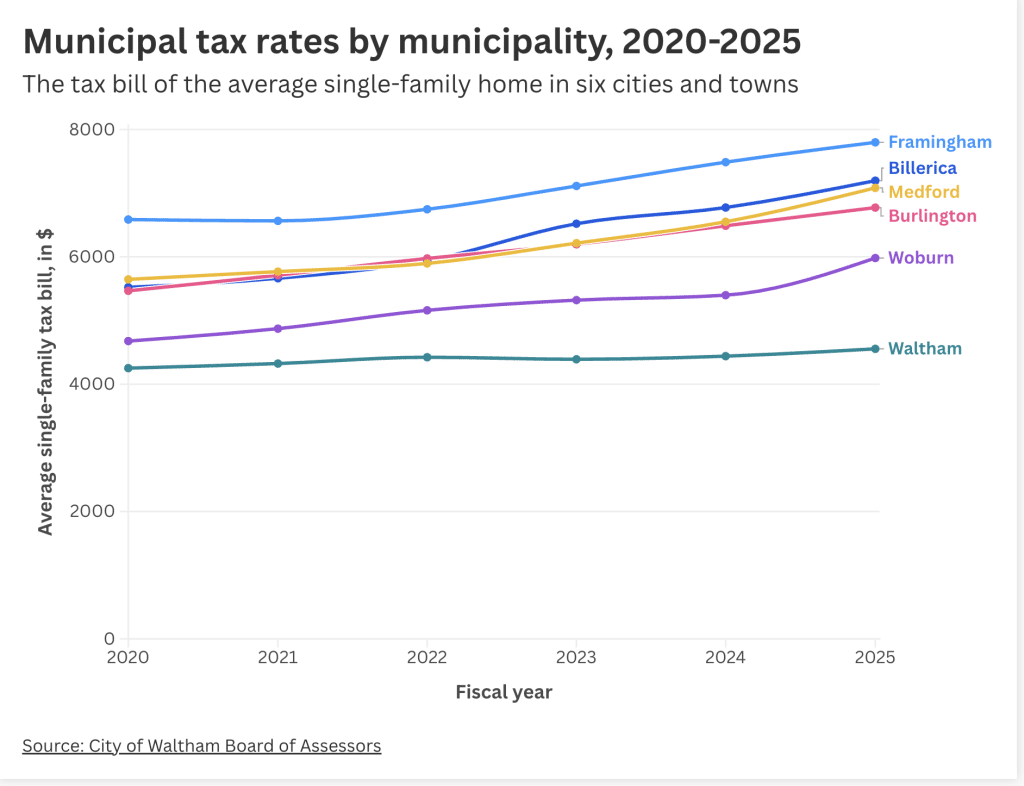

The assessors’ report presented the council with a series of charts comparing Waltham’s taxes to cities such as Framingham and Medford, showing that although Waltham’s home values have climbed at the same pace, its tax rates have remained relatively low.

A shift in commercial business

Craig cautioned the council, however, that the tax hike also signaled a shift in the city’s economic growth.

The city regularly shifts some of the city’s tax burden from residents to commercial and industrial property owners. The City Council voted to set a residential factor that will cause the city’s commercial tax base to pay approximately 45.9% of Waltham’s tax levy in 2026.

Craig told the council, however, that tax redistribution is bounded by the city’s commercial and residential growth. He said that although Waltham saw $75 million dollars in commercial growth this year, that’s only around half of the commercial growth it saw the year before.

He told councilors that the slowdown, driven by “pretty difficult economic times” and significant decreases in the demand for lab space, combined with increased residential values is changing the momentum and direction of Waltham’s growth.

“This feels like a huge transition time for the city,” he said.

Councilor-at-Large Kathy McMenimen pointed out that in the past few years a few large apartment buildings have ranked among the city’s top taxpayers.

Craig said his office identified 33 commercial lots across Waltham that are currently “underperforming” in value. He encouraged the city to find a use for unused commercial lots instead of letting them sit vacant and voiced support for mixed-use zoning overlay districts to attract occupancy. He said this strategy has been a significant success in cities such as Burlington and large real estate companies have observed a trend of businesses relocating to more livable and desirable locations.

Craig added that a shift toward mixed-use properties in commercial districts will still produce economic challenges, as more large residential buildings will mean the city’s residential sector has to pick up a bigger tax bill — but also said the city will need to balance that against an expected five to 10 years of low commercial occupancy or vacancy.

Other tax questions

The City Council also voted to continue applying the maximum allowed residential exemption, which excludes 35% of residential properties’ value from taxation. The exemption will reduce the overall tax bill for primary homes valued at or under around $1.2 million.

The council set the tax rate on the commercial and industrial tax base at $22.18 per $1,000 in profit value, up from $21.04 per $1,000 for 2025.

Councilors asked Craig questions about the residential and commercial tax burden, the Board of Assessors’ real estate assessment process and partnerships, mixed-use zoning, businesses contesting Waltham’s tax assessments and auxiliary dwelling units.

Both McMenimen and Councilor-at-Large Colleen Bradley MacArthur drew attention to the city’s unused levy, which Craig attributed in part to controlled city spending. McMenimen emphasized that this has allowed Waltham the flexibility to respond to emergency costs.

The council additionally voted to assess $1 million in retained earnings from the city’s sewer system as a part of its 2026 revenue to offset a rate increase.

It also voted 11–3 to allocate $4.5 million in tax revenue collected through the Community Preservation Act into the city’s historic, housing, open space, administrative and undesignated CPA accounts. Ward 1 Councilor Anthony LaFauci, Ward 5 Councilor Joey LaCava and Councilor-at-Large Paul J. Brasco voted against this motion.

Although this particular special meeting came after a state-mandated five-year reassessment of land values around the city, which the state signed off on earlier Monday, the council holds a special meeting every year to set tax rates.

Ward 6 Councilor Sean T. Durkee told the Waltham Times that this meeting is an important signpost for city councilors as they determine what budgeting priorities to champion in the new year, as it marks the start of budgeting season and affects the size of the city’s fiscal 2027 budget.

Share anonymous news tips

You can leave a news tip anonymously, but if you would like us to follow up with you, please include your contact information

Comments (4)

Comments are closed.

Great reporting. Very helpful to learn and understand how this all works.

The graph comparing the tax bills of various cities supports what we all hear from others we know in the region about how much lower Waltham taxes are. I live near the huge office parks along Rt 128 on the other side of the Cambridge Reservoir and often bike through them. What you can see from the highway is just the tip of the iceberg. They are now much less active than before Covid resulting from a number of factors, many of which are beyond Waltham’s control. It is ineveitable that the taxes will go up for residents. While we can lament this, those of us who have been here for a while should feel fortunate that we have had so many years of signifantly lower taxes, allowing us to spend, save, and invest more than many others in the region.

There’s something that doesn’t make sense to me. If property values have doubled since 2015, that means the collected residential tax should have doubled (not quite given the exemption), without any change in the rate. That argues for a reduction in the rate, unless the city has considerably increased spending. The increase in property values wouldn’t seem to increase the city’s expenses, so this is free money. Now on top of that, the rate is being increased. I can see some of this need arising from inflation, but this looks well beyond that. I can believe that the money is being to good use, but I would like a more rational explanation.

‘Councilor-at-Large Kathy McMenimen pointed out that in the past few years a few large apartment buildings have ranked among the city’s top taxpayers.’

Yes! Let’s take advantage of this by zoning to encourage positive feedback loops! Allow housing near transit and job centers to cut down on traffic and improve quality of life, all while improving our tax base.